Online Accountant QuickBooks: What Every Founder Needs to Know

Starting a new business is both exciting and challenging. As a founder, you have a lot on your plate—building a product, attracting customers, and creating a strong brand. Amidst all this, managing your finances might seem overwhelming, but it’s a crucial aspect of your business’s success. Online Accountant QuickBooks, more commonly known as QuickBooks Online (QBO) is a powerful tool that can simplify your accounting and provide you with real-time insights into your business’s financial health. In this post, we’ll explore everything you need to know about QuickBooks Online and why it’s a must-have for founders.

Why QuickBooks Online is Essential for Founders

-

Streamlines Financial Management – Online Accountant QuickBooks, more commonly known as QuickBooks Online, automates many accounting tasks, such as tracking income and expenses, generating invoices, and reconciling bank accounts. This automation saves time and reduces the chances of human error, allowing you to focus on growing your business.

-

Real-Time Financial Data – With QuickBooks Online, you can access your financial data anytime, anywhere. This real-time access means you can make informed decisions quickly, whether it’s deciding on a marketing budget or determining if you have enough cash flow for a new hire.

-

Scalable for Growing Businesses – QuickBooks Online offers various plans to fit your business’s size and needs. As your company grows, you can upgrade to more advanced features like inventory management, payroll, and robust reporting. This scalability makes QBO a long-term solution for your business’s accounting needs.

-

Integration with Other Tools – QBO integrates seamlessly with hundreds of apps, including payment processors, CRM systems, and e-commerce platforms. This integration allows you to build a customized financial management system that suits your business processes.

-

Helps Maintain Compliance – Proper accounting is essential for meeting tax obligations and legal requirements. QuickBooks Online helps you keep accurate records, generate necessary reports, and even collaborate with your accountant, making it easier to comply with local, state, and federal regulations.

Key Features of QuickBooks Online Every Founder Should Know

-

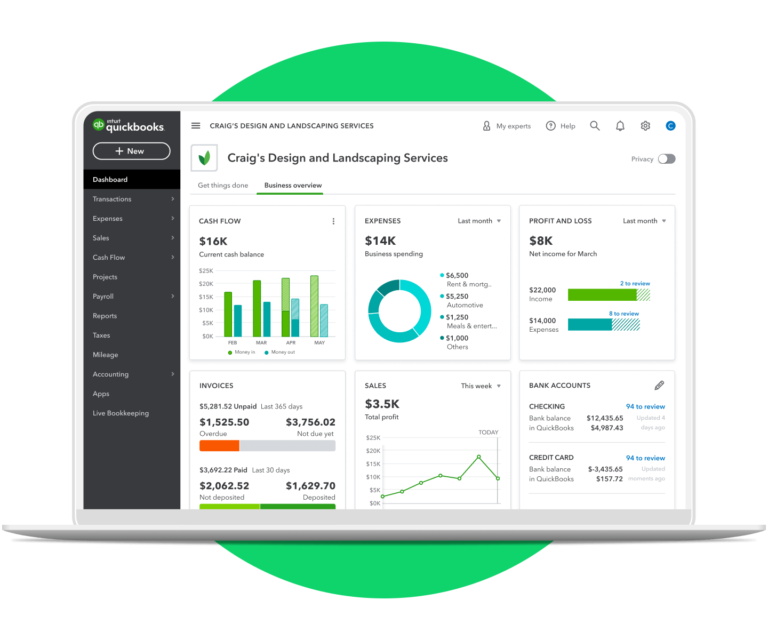

Dashboard Overview – The QBO dashboard gives you a snapshot of your business’s financial health. You can see your bank balances, expenses, income, and outstanding invoices all in one place. This overview helps you stay on top of your finances at a glance.

-

Invoicing and Payments – Create and send professional invoices directly from QBO. You can set up recurring invoices, track payments, and send reminders for overdue accounts. Integrating with payment processors like PayPal and Stripe allows you to receive payments directly through your invoices, speeding up cash flow.

-

Expense Tracking – Link your bank accounts and credit cards to QBO to automatically import transactions. You can categorize expenses, attach receipts, and even split transactions between multiple categories. This feature simplifies expense management and ensures that your books are always up-to-date.

-

Bank Reconciliation – Regularly reconciling your bank accounts ensures that your QBO records match your actual bank statements. QBO’s bank reconciliation tool makes this process easy by matching transactions and highlighting any discrepancies, helping you catch errors or fraudulent activity.

-

Reporting and Insights – QuickBooks Online offers a variety of reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports provide valuable insights into your business’s financial performance, helping you make strategic decisions based on accurate data.

-

Sales Tax Management – If your business sells tangible products or goods, QuickBooks Online can help you manage sales tax. You can set up sales tax rates based on location, apply them to invoices, and generate reports to simplify filing your sales tax returns.

-

Payroll Integration – As your business grows and you start hiring employees, managing payroll becomes critical. QuickBooks Online integrates with QuickBooks Payroll, making it easy to run payroll, track employee hours, and handle payroll taxes—all from within your accounting software. If you are looking for a cost-effective solution, QuickBooks Payroll is one of the lower cost options available on the market.

Need Help Getting Your Startup's Accounting and Taxes Streamlined, Simplified, and Headache-Free?

Schedule a Free Consultation Today

Getting Started with QuickBooks Online

Choose the Right Plan – QuickBooks Online offers several plans: Simple Start, Essentials, Plus, and Advanced. Choose a plan based on your business’s needs. If you’re a solopreneur or have a small team, Simple Start or Essentials may suffice. For larger businesses with complex needs, Plus or Advanced provides additional features like inventory tracking and project profitability. If you need help picking a plan that’s right for you, schedule a free trial and we can help set up your QuickBooks account with you.

Set Up Your Account – After choosing a plan, you’ll need to set up your QBO account. This involves linking your bank accounts, setting up your company profile, and customizing your invoices and sales forms.

Customize Your Chart of Accounts – The Chart of Accounts is the backbone of your accounting system. Customize it to reflect your business’s unique financial structure, including income streams, expense categories, assets, and liabilities.

Connect Apps and Integrations – To get the most out of QuickBooks Online, connect it to other tools you use, such as CRM software, payment processors, or e-commerce platforms. This integration streamlines data flow and reduces manual entry.

Learn the Basics – QuickBooks Online has a learning curve, but there are plenty of resources available, including tutorials, webinars, and help articles. Taking the time to learn the basics will pay off by enabling you to use the software efficiently.

Collaborate with Your Accountant – QuickBooks Online allows you to invite your accountant or bookkeeper to your account. This collaboration feature makes it easy to get professional advice, review your financials, and prepare for tax season.

Tips for Maximizing QuickBooks Online as a Founder

Automate Where Possible – Set up recurring invoices, automated bank feeds, and scheduled reports to save time and reduce manual work.

Use the Mobile App – QuickBooks Online has a mobile app that allows you to track expenses, send invoices, and check financial reports on the go. It’s a handy tool for busy founders who need to manage finances on the move.

Leverage Reports for Decision-Making – Regularly review financial reports to track your business’s performance. Use insights from these reports to make informed decisions about marketing, hiring, and expansion.

Stay Up-to-Date with Reconciliations – Regularly reconciling your bank accounts ensures your books are accurate and helps you spot any discrepancies early.

Keep Learning – QuickBooks Online regularly updates its features and capabilities. Stay informed about new features and best practices to ensure you’re getting the most out of the platform.

Final Thoughts

As a founder, you wear many hats, but accounting doesn’t have to be one of them. QuickBooks Online is an essential tool that simplifies financial management, provides real-time insights, and grows with your business. Whether you’re just starting or scaling your startup, QBO offers the flexibility and functionality to meet your needs.

By understanding and utilizing the features of QuickBooks Online, you can gain better control over your business finances, make informed decisions, and free up more time to focus on what you do best—building your business.

Like this Content and Want More Like it?

Sign up for helpful tips to reduce your taxes, receive tax deadline reminders, and get free resources, guidance, and walkthroughs sent right to your email.

About the Author

Brett Rosenstein

Founder of Build Accounting

Certified Public Accountant

Brett is the founder and president of Build Accounting where he provides accounting, tax filing, and CFO services for tech startups and SaaS businesses. His goal is to make the accounting and tax process as simple, streamlined, and headache-free for business founders as possible.

Brett received a Bachelor of Science in Business Administration from The Ohio State University. He is also a Certified Public Accountant.

When Brett is not working, he is running, biking, spending time with his wife and daughter, or trying new pizza places.

Schedule a Free Trial!

Get started today by scheduling a call to see how we can help your tech startup or SaaS business. We’ll respond as soon as possible.

By submitting this contact form, you consent to receive email communications from Build Accounting, including our newsletter with quick time and tax saving tips. You may opt-out at any time.