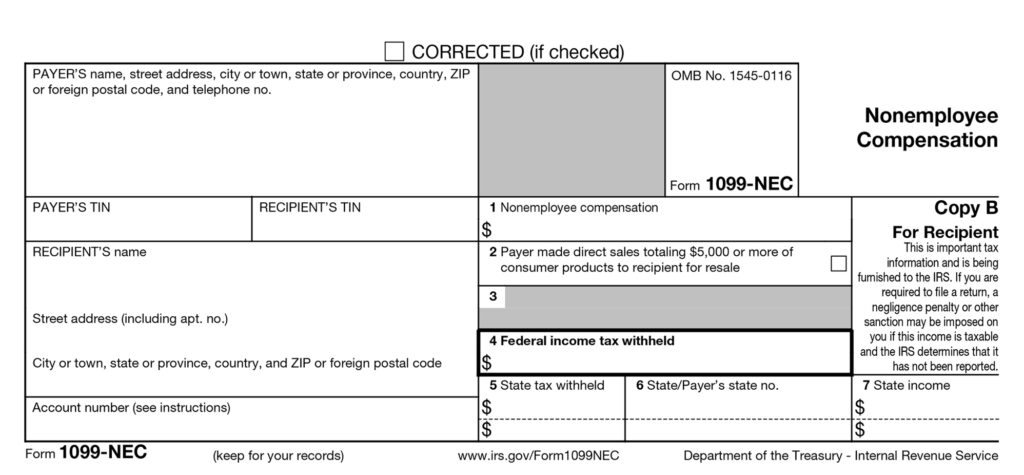

When managing payments for services rendered by independent contractors, businesses are often required to issue IRS Form 1099-NEC (Nonemployee Compensation) or Form 1099-MISC (Miscellaneous Income). However, the rules surrounding when and to whom you issue these forms can be nuanced, especially when it comes to different types of entities such as corporations. One common question is: Does a C corp get a 1099? To answer this, let’s break it down:

Understanding the 1099 Form Requirements

Form 1099 is used by businesses to report payments made to individuals and entities that are not employees. The most common version of this form for independent contractors is Form 1099-NEC, which is issued if you pay $600 or more for services in a year. Form 1099-MISC is often used for other types of payments, such as rent, prizes, awards, or legal settlements.

The General Rule: C Corporations and 1099 Forms

Under IRS guidelines, C corporations are generally exempt from receiving a 1099 form. This means that if your business is paying a C corporation for services, you are not required to issue them a 1099-NEC or 1099-MISC, regardless of the amount paid.

The reasoning behind this exemption is that C corporations are subject to their own tax reporting requirements, such as filing a Form 1120 (U.S. Corporation Income Tax Return). Therefore, the IRS does not require businesses to issue 1099 forms to these entities since their income and expenses are already being reported elsewhere.

Key Exceptions

While most C corporations do not receive 1099 forms, there are a few exceptions where even a C corporation may require one:

Attorney Fees: If your business pays $600 or more to a C corporation for attorney fees, you are required to issue a 1099-NEC or 1099-MISC. Legal services are an exception to the general rule, even when provided by a C corporation.

Medical and Health Care Payments: Payments made to C corporations for medical and health care services also fall under the exception. If your business pays $600 or more to a corporation for these services, a 1099-MISC must be issued.

Fish Purchases for Cash: A lesser-known exception involves the purchase of fish for cash. If you are buying fish from someone in the business of catching fish and they are incorporated, a 1099-MISC may still be required. I’m guessing this doesn’t involve anyone reading this but I thought it was still funny to include.

Need Help Getting Your Startup's Accounting and Taxes Streamlined, Simplified, and Headache-Free?

Schedule a Free Consultation Today

What About S Corporations?

It’s worth noting that S corporations are treated similarly to C corporations in terms of 1099 reporting requirements. Like C corporations, S corporations are generally exempt from receiving a 1099-NEC or 1099-MISC for most payments. However, the same exceptions (attorney fees, medical payments, etc.) apply to S corporations as well.

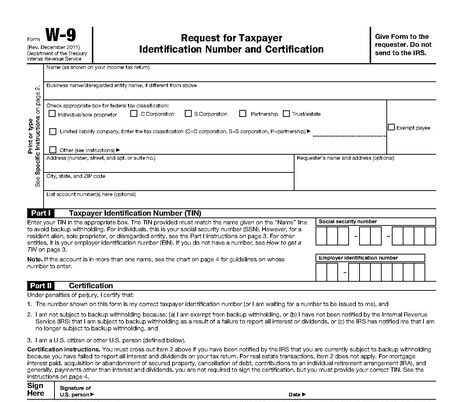

How to Verify Whether a Business is a Corporation

When making payments, it can be tricky to know the recipient’s entity type (sole proprietorship, LLC, S corp, C corp, etc…). To clarify, you should request a Form W-9 from each contractor or vendor. The W-9 form provides the entity’s tax classification, allowing you to determine if a 1099 is necessary. If the vendor checks the box indicating they are a corporation, you’ll know that in most cases, you’re exempt from sending them a 1099.

Conclusion of Does a C Corp Get a 1099

In general, C corporations do not receive a 1099 form for most types of payments. However, there are important exceptions to be aware of, particularly for legal services and health care payments. If you’re unsure whether a business qualifies for a 1099, always refer to their W-9 form and IRS guidelines to ensure you remain compliant. By understanding these rules, your business can streamline its tax reporting process and avoid unnecessary 1099 filings.

Like this Content and Want More Like it?

Sign up for helpful tips to reduce your taxes, receive tax deadline reminders, and get free resources, guidance, and walkthroughs sent right to your email.

About the Author

Brett Rosenstein

Founder of Build Accounting

Certified Public Accountant

Brett is the founder and president of Build Accounting where he provides accounting, tax filing, and CFO services for tech startups and SaaS businesses. His goal is to make the accounting and tax process as simple, streamlined, and headache-free for business founders as possible.

Brett received a Bachelor of Science in Business Administration from The Ohio State University. He is also a Certified Public Accountant.

When Brett is not working, he is running, biking, spending time with his wife and daughter, or trying new pizza places.

Schedule a Free Trial!

Get started today by scheduling a call to see how we can help your tech startup or SaaS business. We’ll respond as soon as possible.

By submitting this contact form, you consent to receive email communications from Build Accounting, including our newsletter with quick time and tax saving tips. You may opt-out at any time.