Converting your LLC to a C Corporation can be a strategic decision that offers potential tax benefits, particularly for businesses aiming to raise capital or qualify for the Qualified Small Business Stock (QSBS) tax exemption. However, the conversion also involves critical tax considerations that must be handled properly to avoid potential pitfalls. This post will walk you through the essential tax steps to convert your business from an LLC to a C corp.

Step 1: Understand the Tax Implications

Before diving into the conversion process, it’s important to understand how an LLC and a C corporation are taxed differently:

- LLC: By default, LLCs are considered pass-through entities. This means the profits and losses of the business pass through to the owners (members) and are taxed at their individual income tax rates. The LLC itself is not taxed unless it opts to be taxed as a corporation.

- C Corporation: C corporations are subject to double taxation, which means the corporation pays taxes on its profits, and shareholders are taxed on dividends they receive. However, C corporations also offer potential tax advantages, such as the Qualified Small Business Stock (QSBS) exclusion and the possibility of deferring taxes by leaving money in the business.

Understanding these tax differences is crucial before moving forward with the conversion.

Step 2: Prepare for Potential Taxable Events

One of the most significant tax considerations to convert an LLC to a C corp is the potential for a taxable event during the conversion. Depending on how the conversion is structured, it may be considered a liquidation of the LLC, which could trigger capital gains taxes for the members.

The following two methods of conversion have different tax consequences:

- Statutory Conversion: This process is available in states that allow direct conversion of an LLC into a C corporation. Generally, this is the most tax-efficient route because the IRS treats it as a nontaxable event under Section 351 of the Internal Revenue Code, which allows the transfer of property to a corporation in exchange for stock without recognizing gains or losses.

- Asset Transfer (Deemed Liquidation): If a direct conversion is not possible, you may need to transfer the LLC’s assets and liabilities to the C corporation in exchange for stock. This can be treated as a taxable liquidation of the LLC, triggering taxes on the appreciated value of the LLC’s assets.

Step 3: Elect the C Corporation Tax Status with the IRS

Once you convert an LLC to a C corp at the state level, you’ll need to notify the IRS of the change in your business’s tax status. This is done by:

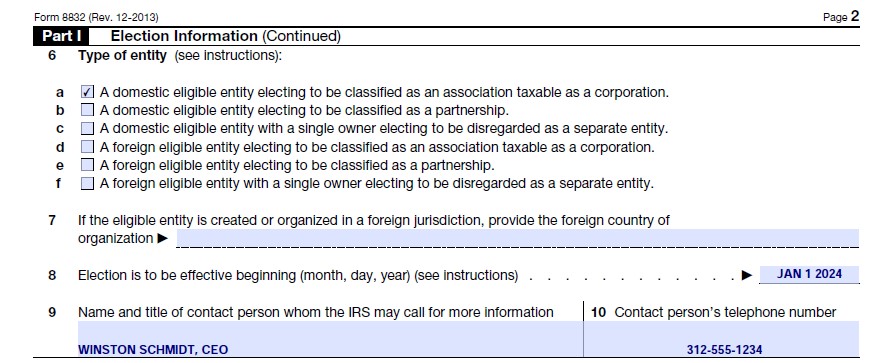

Filing Form 8832 – Entity Classification Election: Use this form to elect to be taxed as a C corporation. You must file this within 12 months of the effective date of the conversion to ensure proper tax classification for the tax year.

2. Apply for a New EIN?: After the conversion, your Corporation may need a new Employer Identification Number (EIN). If your business is the same legal entity and the LLC is simply being taxed as a C corp, you can use the same EIN. However, if a new entity was created, due to a statutory merger, the corporation would need a new EIN. A new EIN can be obtained through the IRS website.

Step 4: Address the LLC’s Final Tax Return

Even though your LLC is converting into a C corporation, you may need to file a final tax return for the LLC. This involves:

Filing the LLC’s Final Return: File your LLC’s final Form 1065 (if taxed as a partnership) or Form 1120-S (if taxed as an S corporation), marking it as the final return. If you have a single-member LLC, there wouldn’t be a final business tax return. Simply, it would be the final Schedule C included on your 1040 tax return at the end of the year. This should cover the LLC’s activities up to the conversion date.

Distributing Remaining Profits: If the LLC has any remaining profits or undistributed earnings before conversion, they should be distributed to members before the conversion. Otherwise, those profits may be subject to double taxation once the C corporation is in effect.

Step 5: Transfer Assets and Liabilities to the C Corporation

For tax purposes, when you transfer the LLC’s assets and liabilities to the C corporation, you’ll need to value these assets properly. Here’s how to handle it:

Valuing Assets and Liabilities: When transferring assets (like real estate, equipment, intellectual property, etc.), ensure they are properly valued. If the LLC’s assets have appreciated in value, this may trigger a taxable event if not structured correctly. Assets transferred in a Section 351 exchange (stock-for-assets) may avoid immediate recognition of gains.

Basis of Assets and Stock: The new C corporation will take a carryover basis in the assets transferred, meaning the tax basis of the LLC’s assets remains the same for the C corporation. However, if the transaction triggers capital gains taxes, the stock received in the new C corporation will have a higher basis.

Need Help Getting Your Startup's Accounting and Taxes Streamlined, Simplified, and Headache-Free?

Schedule a Free Consultation Today

Step 6: Issue Stock

One of the key differences between an LLC and a C corporation is the ability to issue stock. After conversion, the former LLC members will receive shares of stock in the C corporation. Here’s what you need to do:

- Issue Stock to Shareholders: The former LLC members will now own shares in the new C corporation. The value of these shares is based on the total value of the assets transferred to the corporation.

Step 7: Begin Filing as a C Corporation

Once the conversion is complete, you will file tax returns as a C corporation going forward. This means:

Filing Form 1120: Your C corporation will file Form 1120 annually, reporting all corporate income, deductions, and credits. Keep in mind that any profits retained in the corporation will be taxed at the corporate tax rate (currently 21%), and any dividends paid to shareholders will be taxed at the individual level.

Step 8: Consider the Qualified Small Business Stock (QSBS) Exclusion

One of the major advantages of converting to a C corporation is the potential to benefit from the Qualified Small Business Stock (QSBS) exclusion. If your C corporation meets the IRS requirements, shareholders may be able to exclude up to 100% of the gains from the sale of their stock if they hold the shares for at least five years.

To qualify for QSBS:

- The corporation must be a domestic C corporation.

- The corporation must have gross assets of $50 million or less at all times before and immediately after the stock issuance.

- The stock must be newly issued and acquired directly from the corporation.

If your business aims to qualify for this significant tax benefit, make sure to consult with a tax advisor to ensure your corporation meets the necessary criteria.

Step 9: Monitor and Maintain Corporate Tax Status

After the conversion, it’s crucial to adhere to corporate tax requirements to avoid penalties. Some ongoing responsibilities include:

Filing Annual Reports and Paying Franchise Taxes: Most states require C corporations to file annual reports and pay franchise taxes based on their net worth or capital.

Corporate Tax Compliance: Ensure your C corporation stays compliant with IRS regulations by maintaining proper books and records, filing timely tax returns, and adhering to tax payment deadlines.

To Convert an LLC to a C Corp Conclusion

To convert an LLC to a C corp involves careful tax planning and execution. By following these steps and working closely with tax professionals, you can ensure a smooth transition while minimizing the tax liabilities that could arise from the conversion. The long-term benefits of operating as a C corporation, including access to investment capital and potential tax advantages like the QSBS exclusion, can help your business grow and succeed.

If you’re considering converting your LLC to a C corporation, make sure you fully understand the tax implications and plan accordingly for the changes ahead.

Like this Content and Want More Like it?

Sign up for helpful tips to reduce your taxes, receive tax deadline reminders, and get free resources, guidance, and walkthroughs sent right to your email.

About the Author

Brett Rosenstein

Founder of Build Accounting

Certified Public Accountant

Brett is the founder and president of Build Accounting where he provides accounting, tax filing, and CFO services for tech startups and SaaS businesses. His goal is to make the accounting and tax process as simple, streamlined, and headache-free for business founders as possible.

Brett received a Bachelor of Science in Business Administration from The Ohio State University. He is also a Certified Public Accountant.

When Brett is not working, he is running, biking, spending time with his wife and daughter, or trying new pizza places.

Schedule a Free Trial!

Get started today by scheduling a call to see how we can help your tech startup or SaaS business. We’ll respond as soon as possible.

By submitting this contact form, you consent to receive email communications from Build Accounting, including our newsletter with quick time and tax saving tips. You may opt-out at any time.