Converting a C Corporation to an S Corporation (S Corp) can be a strategic move for business owners looking to take advantage of the tax benefits that come with an S Corp status, such as pass-through taxation. This process requires careful planning and execution to ensure compliance with IRS rules. In this guide, we’ll walk you through the step-by-step process of a C Corporation conversion to an S Corporation.

Quick Word of Caution for Startups

If either of these situations apply to you, do not go through the process of a C corporation conversion to an S corporation:

- The business is operating at a loss – the S corp election primarily provides a tax saving benefit. So, if you are a at a loss, switching to an S corp will not provide an advantage as you won’t pay any taxes as a C corp in the first place.

- You have SAFE notes – S corps only allow one class of stock. If you have or plan to raise SAFE notes, this automatically disqualifies an S corp election.

Step 1: Understand the Benefits and Requirements of S Corporation Status

Before starting the conversion process, it’s important to fully understand the benefits and limitations of becoming an S Corporation:

- Pass-through Taxation: Instead of being taxed at the corporate level, income, losses, deductions, and credits are passed through to shareholders and taxed at their individual rates.

- Avoidance of Double Taxation: Unlike C Corporations, which face taxation at both the corporate and shareholder levels (on dividends), S Corporations avoid this double taxation.

Step 2: Confirm Eligibility for S Corporation Status

Before filing for S Corp status, ensure your corporation meets the following IRS requirements:

- Domestic Corporation: Your business must be incorporated in the United States.

- Eligible Shareholders: All shareholders must be U.S. citizens or resident aliens, and none can be partnerships, corporations, or non-resident aliens.

- Single Class of Stock: You must only issue one class of stock, but voting rights can differ.

- Shareholder Count: The company cannot have more than 100 shareholders.

Step 3: Hold a Shareholder Meeting and Approve the Conversion

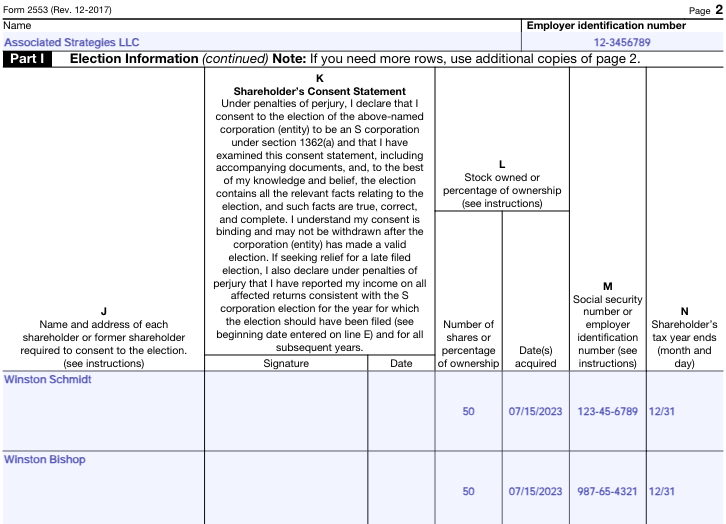

The decision to convert to an S Corporation requires the approval of all shareholders. To begin:

- Call a Shareholder Meeting: Schedule a formal meeting to discuss the conversion.

- Vote on the S Corp Election: All shareholders must unanimously consent to the conversion to S Corporation status.

- Document the Decision: Record the vote in the corporation’s official records and include it in the meeting minutes.

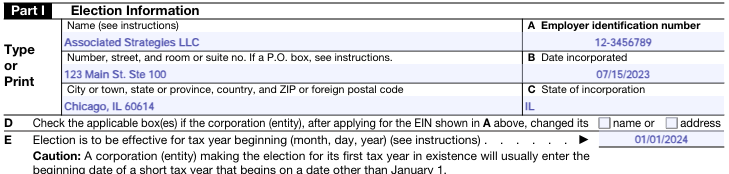

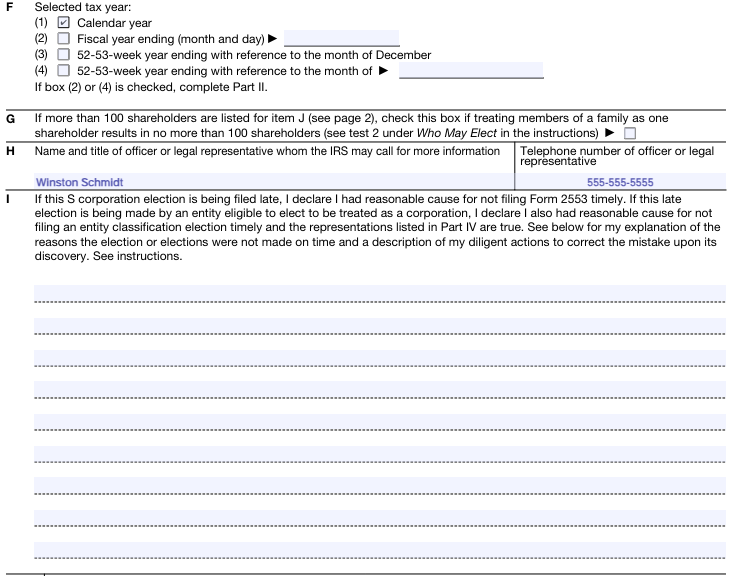

Step 4: File IRS Form 2553

The next step is to officially elect S Corporation status by filing IRS Form 2553, “Election by a Small Business Corporation.” Here’s what you need to know:

- Complete Form 2553: You can download the form from the IRS website. It must be signed by all shareholders.

- Filing Deadline: File within 75 days of the start of the tax year in which you want S Corp status to take effect. If you miss this window, you may file for late election relief by following specific IRS procedures.

- Submit to the IRS: Send the completed and signed form to the IRS. Keep a copy for your records.

Step 5: Adjust the Corporation’s Tax and Accounting Methods

Once your S Corporation election is approved, you’ll need to make changes to your corporation’s tax reporting and accounting methods:

- Income and Loss Allocation: Distribute income, losses, and deductions to shareholders in proportion to their ownership percentage.

- Tax Reporting: The corporation will no longer pay federal income taxes at the corporate level. Instead, shareholders will report their share of the S Corporation’s income on their individual tax returns.

- End Corporate Tax Payments: Cease paying corporate income taxes for the period after the election takes effect. Keep in mind that state taxes may still apply depending on your jurisdiction.

- File Final C Corporation Tax Return: If you complete a C Corporation conversion to an S Corporation, you are required to file a final C Corporation tax return (Form 1120) for the period during which the business was still operating as a C Corporation. This is crucial to ensure that the tax obligations of the C Corporation are fully settled before the S Corporation election takes effect.for

Need Help Getting Your Startup's Accounting and Taxes Streamlined, Simplified, and Headache-Free?

Schedule a Free Consultation Today

Step 6: Update Payroll and Employee Benefits

As an S Corporation, certain payroll and compensation practices may differ from those of a C Corporation:

- Reasonable Compensation: Shareholders who work for the company must be paid a reasonable salary for their services, which is subject to payroll taxes. This prevents the IRS from reclassifying distributions as wages, which would trigger additional payroll tax liabilities.

- Distributions: After paying reasonable compensation, profits can be distributed to shareholders as dividends, which are not subject to employment taxes. If there are multiple shareholders, distributions must be made pro-rata to the percentage of ownership.

Step 7: Adjust Your Balance Sheet and Capital Accounts

Converting to an S Corporation also affects your balance sheet and capital accounts:

- Track Shareholder Distributions: S Corporations must keep track of distributions to ensure they do not exceed the shareholder’s basis in the company, as excess distributions may be taxable.

- Reconcile Equity: Adjust retained earnings from the C Corporation, and track the changes in equity as the S Corporation moves forward. You’ll need to keep detailed records of shareholder capital accounts for tax purposes.

Step 8: Prepare for S Corporation Tax Returns

After the conversion is complete, your company will file taxes as an S Corporation:

- Form 1120-S: Your S Corporation will file IRS Form 1120-S, “U.S. Income Tax Return for an S Corporation,” instead of Form 1120, which is used for C Corporations.

- Schedule K-1: Each shareholder will receive a Schedule K-1 (Form 1120-S) showing their share of the corporation’s income, deductions, and credits, which they will report on their individual tax returns.

Step 9: Stay Compliant with Ongoing Requirements

Maintaining S Corporation status requires ongoing compliance with IRS regulations. Make sure to:

- Monitor Shareholder Eligibility: Ensure shareholders remain eligible under S Corp rules. Any changes in ownership that would disqualify the S Corp election need to be addressed immediately.

- Track Taxable Events: Stay on top of taxable events such as compensation adjustments, profit distributions, and capital contributions.

- Retain Good Standing: Continue to meet state and local compliance obligations, including annual reports, corporate minutes, and filings.

Conclusion of C Corporation Conversion to S Corporation

A C Corporation conversion to an S Corporation is a straightforward process, but it requires close attention to IRS requirements and deadlines. By following the steps outlined above and keeping meticulous records, you can enjoy the benefits of S Corporation status, such as pass-through taxation and reduced tax liabilities for shareholders.

If you’re considering converting your C Corporation to an S Corporation, consult with a tax professional or accountant to ensure the process goes smoothly and to avoid any unintended tax consequences.

Like this Content and Want More Like it?

Sign up for helpful tips to reduce your taxes, receive tax deadline reminders, and get free resources, guidance, and walkthroughs sent right to your email.

About the Author

Brett Rosenstein

Founder of Build Accounting

Certified Public Accountant

Brett is the founder and president of Build Accounting where he provides accounting, tax filing, and CFO services for tech startups and SaaS businesses. His goal is to make the accounting and tax process as simple, streamlined, and headache-free for business founders as possible.

Brett received a Bachelor of Science in Business Administration from The Ohio State University. He is also a Certified Public Accountant.

When Brett is not working, he is running, biking, spending time with his wife and daughter, or trying new pizza places.

Schedule a Free Trial!

Get started today by scheduling a call to see how we can help your tech startup or SaaS business. We’ll respond as soon as possible.

By submitting this contact form, you consent to receive email communications from Build Accounting, including our newsletter with quick time and tax saving tips. You may opt-out at any time.